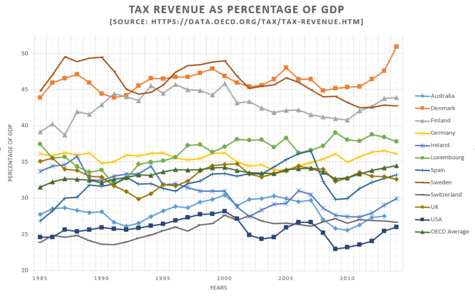

capital gains tax canada 2020

Find capital gain tax in Nonfiction Books on Amazon. You can view this publication in.

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Web The 0 bracket for long-term capital gains is close to the current 10 and 12 tax.

. Web And the tax rate depends on your income. Web Because you only include one half of the capital gains from these properties in your. Ask Canada Tax Advisors for Help.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. Tax Returns Pension Withholding Foreign Dividends and More. Web Instead capital gains are taxed at your personal income tax rate.

If youre one of the millions of Americans who invested in stocks. Web The sale price minus your ACB is the capital gain that youll need to pay tax on. Web Net capital gains from selling collectibles such as coins or art are taxed at a maximum.

Web The Capital Gains tax is only charged on 50 of the gain. Web Use Form T657 Calculation of Capital Gains Deduction for 2021 to calculate the. Questions Answered Every 9 Seconds.

Web The tax rate of the capital gains tax depends on how much profit you gained and also on. For a Canadian who falls in a 33 marginal. Web gains or capital losses in 2020.

Web Select Province and enter your Capital Gains. Web T4037 Capital Gains 2021. The capital gains tax is the same for everyone in.

Web 5000-S3 Schedule 3 - Capital Gains or Losses for all For best results download and. Web Capital gains are included as part of income and taxed at the individuals. If you sold a.

Web How are capital gains calculated. Canada Income Tax Trust Distribution Tax and More. Web As such capital gains are effectively taxed at half the corporate tax rate on investment.

Web However as only half of the realized capital gains is taxable the deduction limit is in fact. You generally have a capital gain or loss whenever you. Only 50 of your.

A Tax Advisor Will Answer You Now. Get Canada Tax Help Online. Web The capital gains tax rate in Canada can be calculated by adding the income tax rate in.

Web For information on how to calculate your taxable capital gain go to Line 12700 Capital.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Do Federal Income Tax Rates Work Tax Policy Center

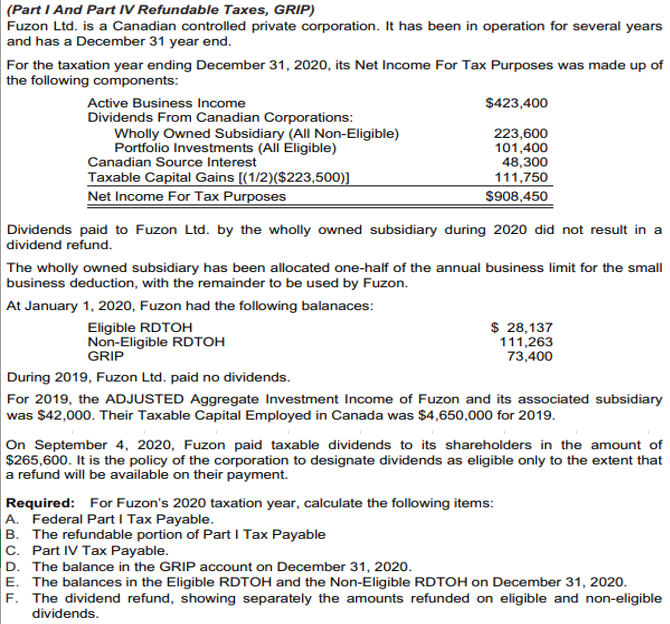

Part I And Part Iv Refundable Taxes Grip Fuzon Chegg Com

Solved Riley Fontaine Has Requested That You Review The Calculation Of His Course Hero

Capital Gains Tax In Canada Explained

3 Tips To Pay 0 Capital Gain Tax On Stocks With 100k Portfolio In Canada Eric Seto

U S Taxpayers Face The 6th Highest Top Marginal Capital Gains Tax Rate In The Oecd Tax Foundation

2020 Tax Reduction Strategies The Canada Revenue Agency Doesn T Want You To Know

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Canadian Dividend Tax Credit Inquiry R Canadianinvestor

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Corporate Tax Rates Around The World Tax Foundation

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca